straight life annuity death benefit

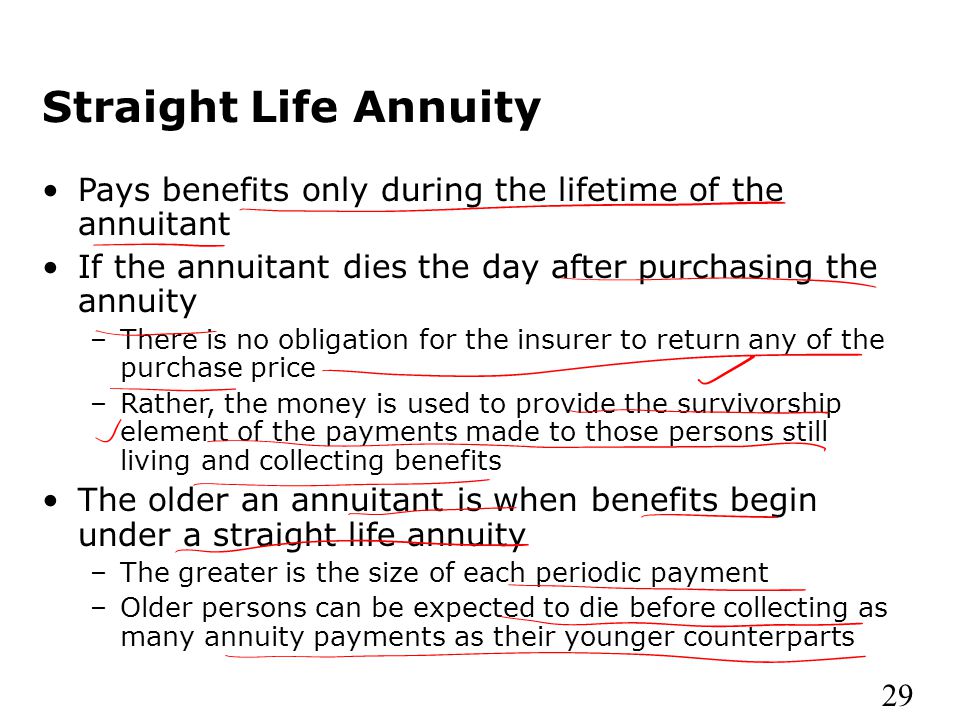

Aside from death benefit upgrades there are other riders that can increase an annuitys value. Of all four options Option 1 Straight Life Annuity provides the maximum monthly benefit payment throughout your lifetime.

There is no beneficiary component to straight life annuities.

. When the annuitant dies payments cease. In most cases there is no death benefit or ongoing payments to heirs. Straight life annuities dont offer beneficiary payments.

Straight life annuities may not be the ideal option for persons who want to provide financial support for their families after they pass away. For example you may be able to add a rider to cover long-term care in case you need nursing home care in retirement. A straight life annuity is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

They stop paying upon the death of the. So instead of providing a death benefit it has higher guaranteed payments while the annuitant is alive. Straight life annuities do not include a death benefit so payments cant be made to a beneficiary.

Annuity Death Benefit Riders. A key benefit of the straight life annuity is that annuitants will receive the highest regular payment for the amount of the lump sum they deposited. This option provides you with the highest monthly benefit for your lifetime.

A straight life annuity will guarantee you a stream of payments throughout your life but those payments end upon death. However all payments stop at your death. Unlike the other benefit options straight life has no provisions for extending annuity payments to a beneficiary or survivor for an exception see the section.

Because the payouts will be shorter in duration they offer the highest periodic payments. Please think carefully about choosing this option if you. Option D - STRAIGHT LIFE ANNUITY Option D - Straight Life Annuity.

This means that if you are married no pension benefit will be paid to your spouse after your death. What type of premium does a straight life policy have. Top Crane Companies Act Top 100 Crane Companies Top Ten Annuity Companies.

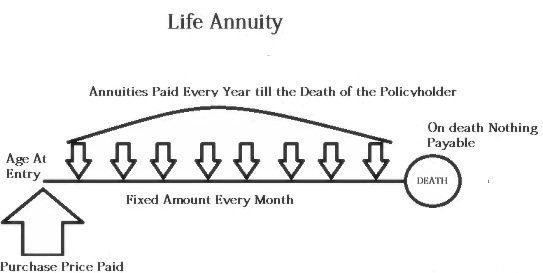

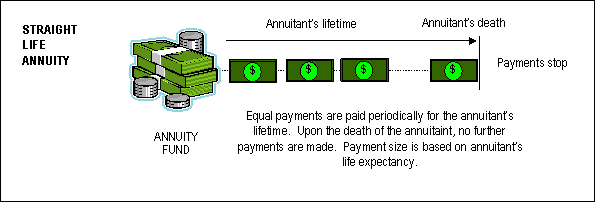

How a Straight Life Annuity Works. With a straight life annuity you pay a certain amount of money and then receive regular payments until you die. On the death of the retiree the monthly payments end.

A straight life insurance policy is a form of permanent life insurance with set premiums that provides a guaranteed death benefit. Offer helpful instructions and related details about Straight Life Annuity Death Benefit - make it easier for users to find business information than ever. But when you buy an annuity with a straight life payout it doesnt have this as a benefit.

The straight life option pays a monthly annuity directly to the retiree for life. The policys duration is your entire lifetime which is different from term life insurance which ends after a specified number of years. A straight life annuity will guarantee you a stream of payments for the rest of your life but those payments will stop when you die.

During retirement annuitants receive an income that is guaranteed to last throughout. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. There is typically no death benefit or continued payments for any heirs.

Other forms of annuity pay you only for a certain amount time. The best way to describe the difference is that a beneficiary would get the money but a successor holder would get the account. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Unlike permanent life insurance straight life annuities dont offer a death benefit for your beneficiaries. When you buy an annuity you can choose a beneficiary who will get money from the payments at your death. Having this rider could reduce the amount of the death benefit.

They payout until you die and then the payments stop. You dont have to worry that youve saved too little or too much. Straight life is the simplest benefit option offered by APERS.

Trust if one exists 7. The unique aspect of a straight life annuity is that after the annuitant dies the payments stop and he or she their spouse or heirs receive no money or death benefits. In other words a straight life annuity provides predictable income you cant outlive.

The term straight refers to the whole life insurance policys. One of the major benefits that comes with investing in a straight life annuity is that you can create a regular income for yourself during your retirement years. Under this option no monthly benefits will be payable to your beneficiary after your deathUpon your death all monthly benefits cease and any applicable lump sum death benefit or residual accumulated member contributions will be paid to the.

The Straight Life Option. If you use our online form you will be given the opportunity to upload the members death. To offset the cost of the survivor benefit the straight-life annuity benefit is reduced.

They provide income during an annuitants retirement and it is guaranteed to last the. Straight life annuities may not be the best option for people who hope to financially support their families after they die. Its possible to purchase an annuity with a range of payment terms such as one that provides a death benefit to a beneficiary or one that continues payments to a beneficiary if the annuitant.

This makes straight life.

Joint And Survivor Annuity The Benefits And Disadvantages

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuities And Individual Retirement Accounts Ppt Video Online Download

Period Certain Annuity What It Is Benefits And Drawbacks

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

What Is A Straight Life Annuity Everything You Need To Know

Straight Life Annuity Providing Peace Of Mind In Your Retirement

What Is A Straight Life Annuity Retirement Watch

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Straight Life Annuity Definition

Annuity Payout Options Immediate Vs Deferred Annuities